EXAMPLE FINANCIAL MODEL

The Financial Model in assessing a real Joint Venture Investment:

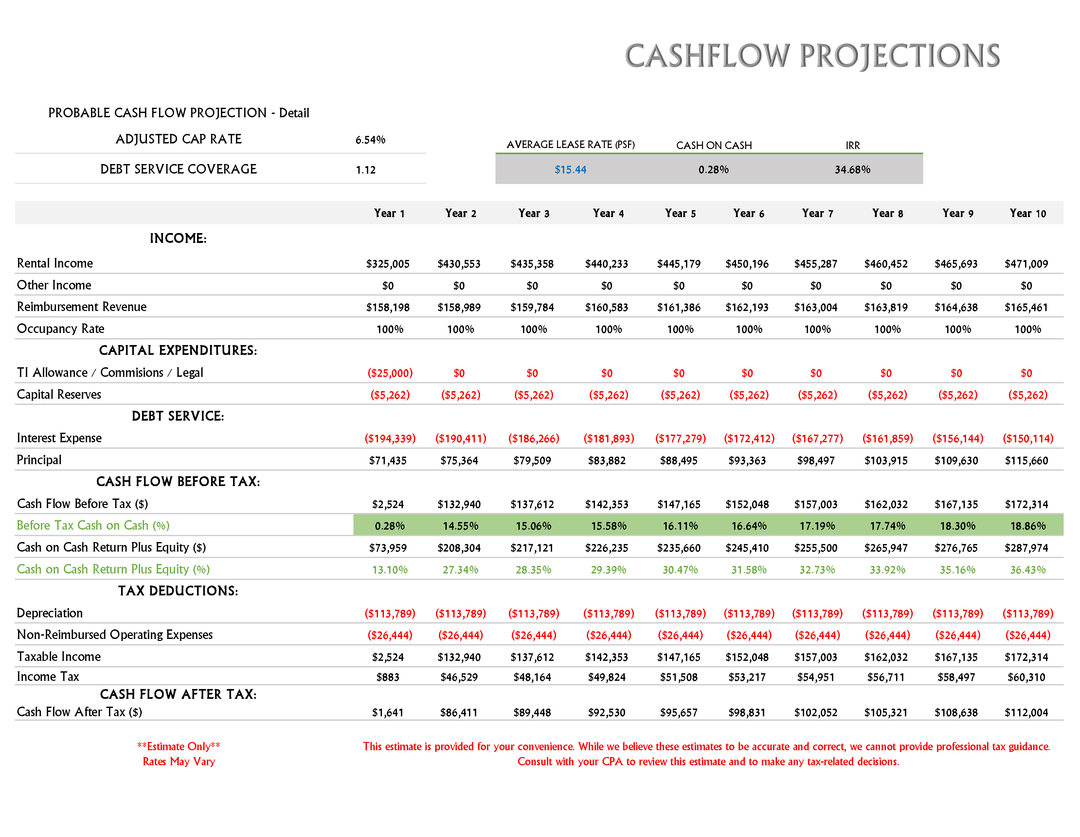

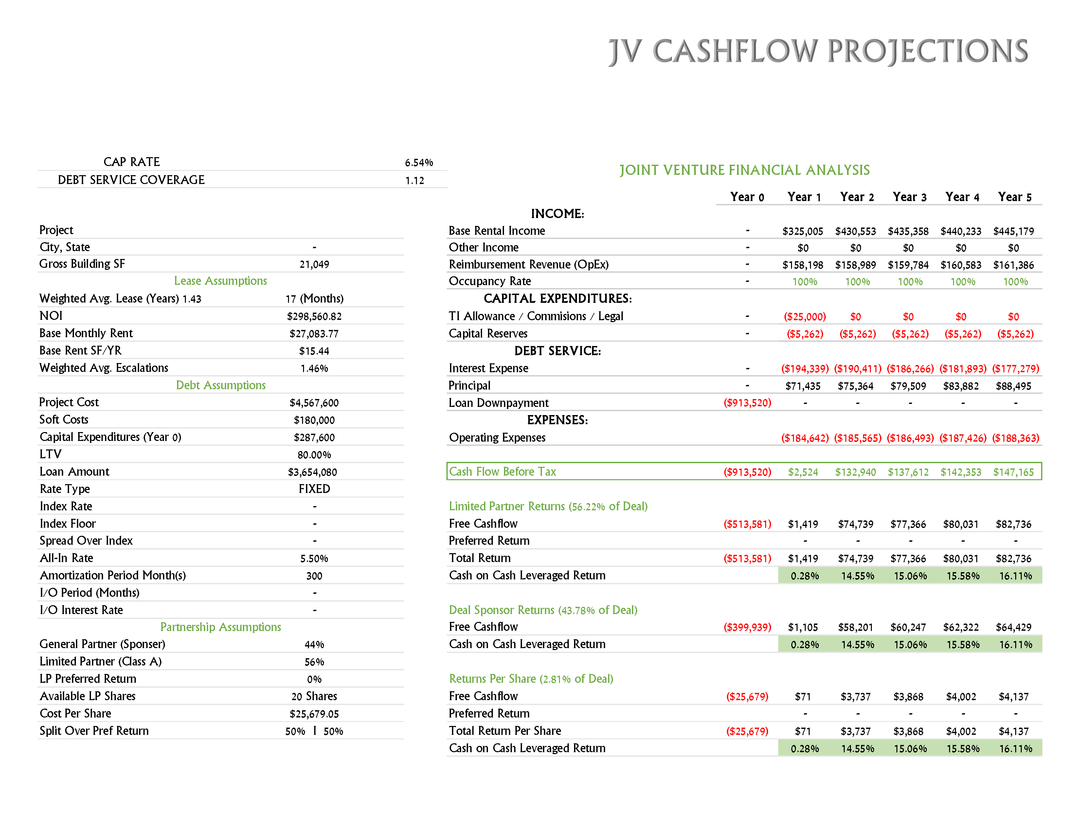

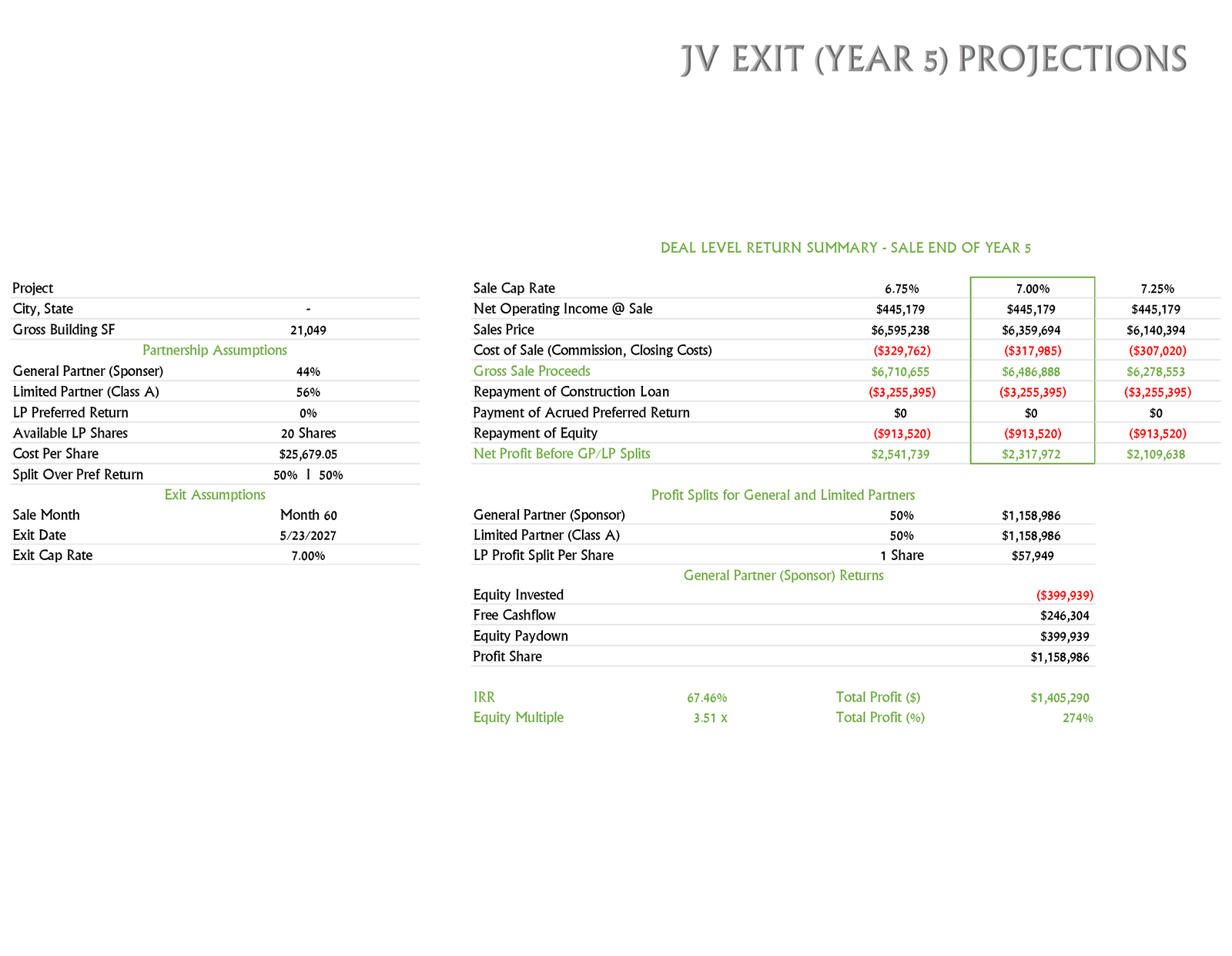

The following models are an example of a Provider looking to purchase a building to occupy. There was also a new lease that would commence on Year-3. Once the building was 100% occupied per the leases in place, we were evaluating the cash flow / returns / & sale price value of this property.

These numbers are not meant to overwhelm you. Rather, they tell a story and identify whether the deal is a good investment to move forward on and what level of risk is involved.